What Is the Average Family Credit Card Debt in 2006

Average American Credit Card Debt in 2021: $5,525

Paradigm source: Getty Images

According to the most recent research, the average American credit card debt is $v,525. The average card residuum has decreased by $968 from where it was earlier the COVID-19 pandemic, and the total U.Southward. credit card debt has also gone downwards to $787 billion.

While those are the overall numbers, they vary significantly for different demographics. Nosotros've reviewed data from regime agencies and credit bureaus to notice the boilerplate credit card debt by state, age, income, and much more. Proceed reading for the total results.

Fundamental findings

- Average American credit card debt: $5,525

- Average credit utilization charge per unit: 25.ii%

- State with the highest average credit carte du jour debt: Alaska ($seven,089)

- State with the lowest average credit card debt: Wisconsin ($4,587)

- Generation X has average credit carte du jour debt of $7,236, the most of any generation.

- Higher income corresponds to college average credit card balances, but consumers in the heart income brackets are the nigh likely to have credit carte debt.

- Credit bill of fare interest rates have been ascent, and the boilerplate rate is at present 16.2% on interest-bearing accounts.

- Delinquency rates accept been steadily decreasing, with the rate of delinquencies of 90 days or more falling the most.

- The average credit card balance has dropped by $968 since earlier the COVID-19 pandemic.

Average American credit card debt

The boilerplate American has a credit bill of fare balance of $v,525.

Although that'southward a big amount, information technology has been dropping over the last 2 years. The boilerplate balance was $6,629 in 2019 and $5,897 in 2020. That information comes from Experian and its yearly State of Credit reports.

U.S. credit card debt equally a whole reached an all-fourth dimension high in 2019. Since peaking at $930 billion in the fourth quarter of that year, it has fallen by over 15%, even though the full U.S. debt has kept going up.

| Year | Credit menu debt | Full debt | Credit card debt percentage |

|---|---|---|---|

| 2003 | $693 billion | $seven.38 trillion | 9.iv% |

| 2004 | $697 billion | $8.46 trillion | 8.ii% |

| 2005 | $697 billion | $9.47 trillion | 7.4% |

| 2006 | $739 billion | $x.75 trillion | half dozen.9% |

| 2007 | $796 billion | $eleven.85 trillion | 6.vii% |

| 2008 | $850 billion | $12.threescore trillion | half dozen.7% |

| 2009 | $824 billion | $12.40 trillion | 6.6% |

| 2010 | $744 billion | $11.94 trillion | six.2% |

| 2011 | $694 billion | $11.73 trillion | five.9% |

| 2012 | $668 billion | $eleven.38 trillion | v.9% |

| 2013 | $669 billion | $11.xv trillion | half-dozen.0% |

| 2014 | $669 billion | $xi.63 trillion | 5.8% |

| 2015 | $703 billion | $11.85 trillion | 5.nine% |

| 2016 | $729 billion | $12.29 trillion | 5.9% |

| 2017 | $784 billion | $12.84 trillion | 6.1% |

| 2018 | $829 billion | $13.29 trillion | six.2% |

| 2019 | $868 billion | $13.86 trillion | 6.3% |

| 2020 | $817 billion | $14.27 trillion | five.7% |

| 2021 | $787 billion | $xiv.96 trillion | five.three% |

Data source: Federal Reserve Bank of New York (2021). Debt statistics are from the second quarter of each year.

While it has been a very gradual change, credit carte debt has become a smaller portion of Americans' total household debt.

What is the average American credit carte debt per household?

The average American credit bill of fare debt per household is virtually $half-dozen,125, based on the most recent U.S. credit menu debt and household data.

Average credit card debt per household was calculated by dividing U.South. credit card debt in 2021 ($787 billion) by the nearly contempo number of households taken in 2020 (128.45 million).

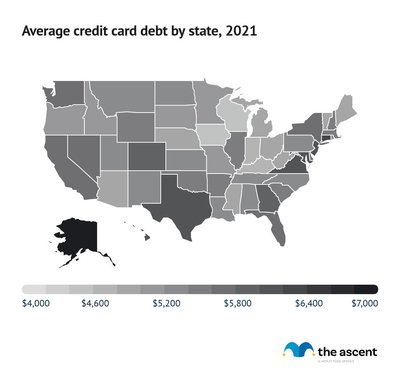

Boilerplate credit card debt past state

Credit bill of fare debt numbers vary quite a bit past state. Here's a full list of each state'south average credit carte du jour remainder as of 2021.

| State | Boilerplate credit card debt |

|---|---|

| Alabama | $5,258 |

| Alaska | $7,089 |

| Arkansas | $4,964 |

| Arizona | $5,414 |

| California | $5,635 |

| Colorado | $5,909 |

| Connecticut | $6,237 |

| Delaware | $five,581 |

| Florida | $5,748 |

| Georgia | $five,822 |

| Hawaii | $6,197 |

| Idaho | $5,025 |

| Illinois | $5,552 |

| Indiana | $4,796 |

| Iowa | $4,587 |

| Kansas | $5,308 |

| Kentucky | $4,772 |

| Louisiana | $v,355 |

| Maine | $four,950 |

| Maryland | $vi,164 |

| Massachusetts | $5,448 |

| Michigan | $four,850 |

| Minnesota | $5,115 |

| Mississippi | $4,819 |

| Missouri | $5,117 |

| Montana | $5,223 |

| Nebraska | $iv,985 |

| Nevada | $5,651 |

| New Hampshire | $5,496 |

| New Jersey | $6,115 |

| New Mexico | $5,203 |

| New York | $5,754 |

| North Carolina | $5,361 |

| North Dakota | $v,223 |

| Ohio | $4,968 |

| Oklahoma | $5,571 |

| Oregon | $v,124 |

| Pennsylvania | $v,293 |

| Rhode Isle | $5,324 |

| S Carolina | $5,523 |

| South Dakota | $5,007 |

| Tennessee | $five,234 |

| Texas | $6,033 |

| Utah | $5,233 |

| Vermont | $4,963 |

| Virginia | $6,189 |

| Washington | $v,684 |

| Washington, D.C. | $6,367 |

| Due west Virginia | $4,831 |

| Wisconsin | $four,587 |

| Wyoming | $v,584 |

Data source: Experian (email advice, 2021).

States with the highest credit card debt

Alaska has had the highest credit menu debt in recent years, and in 2021, it was 28% more the national average.

- Alaska: $seven,089

- Washington, D.C.: $6,367

- Connecticut: $6,237

- Hawaii: $6,197

- Virginia: $half dozen,189

States with the everyman credit card debt

Wisconsin and Iowa both have 17% less credit bill of fare debt than the national average, but it's Wisconsin that's the official winner. Earlier rounding off, its average credit card debt beat Iowa'southward by a razor-sparse margin of $0.08.

- Wisconsin: $4,587

- Iowa: $4,587

- Kentucky: $4,772

- Indiana: $four,796

- Mississippi: $iv,819

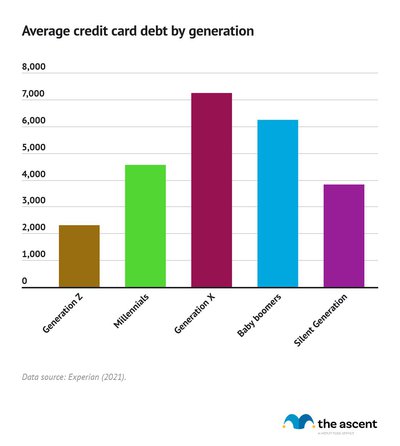

Boilerplate credit menu debt by age

Generation X carries the highest average credit card residual at $vii,236. That's over $i,000 more than baby boomers, who came in second with an average balance of $6,230.

The lowest average credit carte debt by age was Generation Z with $2,312. Since young adults have lower incomes on average, they also accept a lower average credit limit, which at least helps with avoiding credit carte debt.

| Generation | Average credit card debt |

|---|---|

| Generation Z | $ii,312 |

| Millennials | $4,569 |

| Generation X | $7,236 |

| Baby Boomers | $six,230 |

| Silent Generation | $3,821 |

Data source: Experian (2021).

Average credit menu debt for higher students

College students accept an boilerplate credit card debt of $1,183.

Because students are often on a tight upkeep, their credit carte du jour balances are much lower than the average. Even though that's a good sign, a lower-than-boilerplate residuum can still be hard to pay off when you take a express income.

| Yr | Boilerplate credit card debt, college students |

|---|---|

| 2016 | $903 |

| 2019 | $one,183 |

Data source: Sallie Mae (2019).

Average credit bill of fare debt by income

Americans in higher income brackets acquit higher credit card balances on average.

Still, information technology's the center class and the upper-middle form that's more likely to have credit card debt. Among Americans in the 60th through 79th income percentiles, 56.viii% have credit menu debt. Those in the 40th through 59th income percentile weren't far backside, equally 55% have credit card debt.

It's the Americans in the highest (90th to 100th) and everyman (under 20th) income percentiles who are least likely to carry a residuum. Less than a third of each group has credit carte du jour debt.

| Income percentile | Median annual income | Average credit card debt | Pct with credit card debt |

|---|---|---|---|

| Less than twenty | $16,290 | $iii,830 | 30.5% |

| xx–39 | $35,630 | $4,650 | 45.vi% |

| 40–59 | $59,050 | $4,910 | 55.0% |

| threescore–79 | $95,700 | $6,990 | 56.8% |

| fourscore–89 | $151,700 | $nine,780 | 45.9% |

| 90–100 | $290,160 | $12,600 | 32.2% |

Data source: Federal Reserve Survey of Consumer Finances (2020).

Editor's note: Data from the Survey of Consumer Finances was nerveless in 2019, and is the most contempo bachelor from the Federal Reserve.

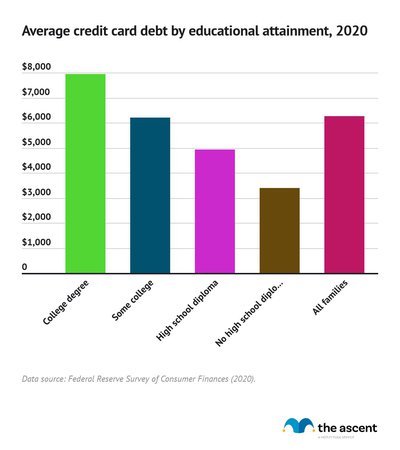

Average credit bill of fare debt by level of pedagogy

Boilerplate credit card debt is higher for Americans with higher levels of teaching.

College graduates accept the highest average credit card debt at $7,940. On the other hand, those with no high school diploma accept $three,390 in average credit carte du jour debt.

The most reasonable caption for this is each grouping's respective income. Median income increases at each level of teaching. Equally an instance, Americans with a bachelor'south caste earn over twice equally much as Americans with no loftier school diploma. Higher income, as we saw earlier, corresponds to higher credit card debt.

| Educational attainment | Boilerplate credit card debt |

|---|---|

| College degree | $7,940 |

| Some college | $half-dozen,210 |

| Loftier school diploma | $4,940 |

| No high schoolhouse diploma | $three,390 |

| All families | $6,270 |

Data source: Federal Reserve Survey of Consumer Finances (2020).

Average credit card debt by race

White Americans have boilerplate credit carte du jour debt of $6,940, the about of any racial group.

Black Americans have the lowest boilerplate credit bill of fare debt at $3,940, and Hispanic Americans are right in betwixt those two other groups with $5,510 in average credit menu debt.

| Race/ethnicity | Average credit card debt |

|---|---|

| White, non-Hispanic | $6,940 |

| Black, non-Hispanic | $3,940 |

| Hispanic | $5,510 |

| Other | $six,320 |

| All families | $6,270 |

Data source: Federal Reserve Survey of Consumer Finances (2020).

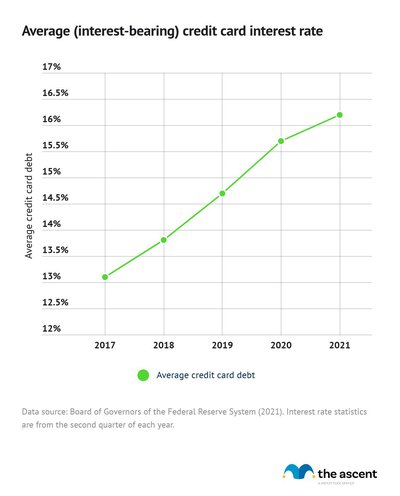

Average credit carte du jour involvement rates

The average credit card APR on interest-bearing accounts is xvi.two%.

Involvement-bearing accounts include all credit cards that accuse interest. It excludes credit cards that aren't charging involvement at that fourth dimension, so 0% intro APR credit cards don't count until the introductory period ends.

| Yr | Average (interest-bearing) credit carte du jour interest rate |

|---|---|

| 2017 | 13.1% |

| 2018 | 13.eight% |

| 2019 | 14.7% |

| 2020 | 15.seven% |

| 2021 | 16.2% |

Data source: Board of Governors of the Federal Reserve System (2021). Involvement rate statistics are from the second quarter of each twelvemonth.

Credit menu interest rates accept been steadily increasing at a charge per unit of nearly 0.8% per yr since 2017. They slowed down a chip this last year, when they grew by 0.5%.

Interest income makes up a meaning chunk of credit card company earnings. It was 43% of the $176 billion credit card companies fabricated in 2020.

Credit card delinquency rates

A credit bill of fare account is considered delinquent when information technology's at least 30 days past due. Although that already does significant damage to the cardholder's credit score and carries financial penalties, the consequences get worse as the card passes threescore and 90 days past due.

Credit card delinquency rates have fallen over the past two years. Delinquencies of 90 days or more have seen the best results, equally they're down 63%.

| Days by due | 2019 | 2020 | 2021 |

|---|---|---|---|

| 30–59 | three.9% | ii.4% | two.3% |

| threescore–89 | 1.9% | i.3% | ane.0% |

| ninety or more | 6.8% | iii.8% | 2.5% |

Data source: Experian (2020).

Credit carte malversation rates by generation

Millennials and Generation X have the highest credit card delinquency rates past a large margin in 2021. Members of the Silent Generation are the to the lowest degree likely to exist runaway on their credit cards.

| Generation | 30–59 days | sixty–89 days | xc or more days |

|---|---|---|---|

| Generation Z | 2.12% | 0.95% | one.73% |

| Millennials | 3.07% | one.32% | iii.xv% |

| Generation 10 | 3.02% | one.25% | 3.42% |

| Infant Boomers | i.80% | 0.77% | 2.05% |

| Silent Generation | 1.07% | 0.51% | i.33% |

Information source: Experian (2021).

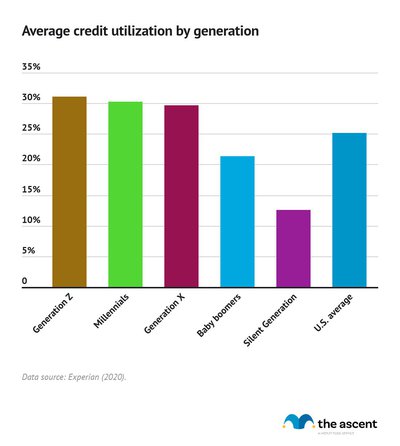

Boilerplate credit utilization charge per unit by age

The average credit utilization rate is 25.ii%.

This metric, also known every bit a credit utilization ratio, is your credit card balances divided past your credit limits. If y'all have i credit carte du jour with a $1,000 balance and a $10,000 credit limit, so your credit utilization would be x%.

Lower credit utilization is better for your credit score, and the conventional wisdom is that you should go on it below thirty%. Most generations manage that. While Gen Z, millennials, and Gen X all have averages of around 30%, the average credit utilization drops quite a chip for baby boomers and the Silent Generation.

| Generation | Average credit utilization |

|---|---|

| Generation Z | 31.i% |

| Millennials | xxx.2% |

| Generation X | 29.vii% |

| Babe boomers | 21.4% |

| Silent Generation | 12.vi% |

| U.Southward. Average | 25.two% |

Data source: Experian (2020).

How the COVID-19 pandemic afflicted credit menu debt

Since the early stages of the COVID-19 pandemic, credit menu balances accept declined sharply. The average credit card balance was almost 13% lower in March 2021 than it was the year earlier, according to a report by the Consumer Fiscal Protection Bureau.

The boilerplate credit card remainder of $5,525 reported by Experian is a decrease of $968 from where it was prior to COVID-19.

Delinquency rates have also declined. The aid programs that credit card companies offered during the pandemic may take played a part in helping cardholders avert delinquencies. In April 2020, 2% of open up credit card accounts started reporting assistance.

Virtually cardholders didn't demand assistance programs for long. Well-nigh 0.8% of credit card accounts transitioned out of aid in May 2020, and some other i.1% of accounts transitioned out in June 2020.

How to go out of credit menu debt

As we've seen from these credit card debt statistics, owing coin to credit carte du jour companies is a very mutual upshot. Many Americans accept expensive credit card balances that are costing them interest every calendar month.

If y'all're in this situation, hither are some methods to consider that can aid you become out of credit carte debt:

- Keep your credit card charges to a minimum. Either don't utilise credit or just use it for necessary expenses and so you don't add together to your debt.

- Cut spending where you can. Await at your recent spending, encounter if in that location's anywhere yous tin can cut back, and make a budget that you can utilise going frontward. There are several budgeting apps that can assistance hither. Put as much dispensable income as possible towards your credit bill of fare payments.

- Expect into balance transfer credit cards and debt consolidation loans. These are both financial tools that you can utilise to pay off debt. Residual transfer credit cards offering a 0% intro APR on credit carte debt you transfer over. Debt consolidation loans typically have lower interest rates than most credit cards. They besides have a fixed payment amount and length, which can provide the structure needed to eliminate credit bill of fare debt.

Sources

- Board of Governors of the Federal Reserve Arrangement (2021). "Commercial Depository financial institution Interest Rate on Credit Card Plans, Accounts Assessed Interest-Federal Funds Constructive Rate."

- Consumer Financial Protection Bureau (2021). "Credit carte du jour use is however declining compared to pre-pandemic levels."

- Consumer Financial Protection Bureau (2020). "The Early Furnishings of the COVID-nineteen Pandemic on Consumer Credit."

- Experian (2020). "Credit Carte du jour Debt in 2020: Balances Drop for the First Time in Eight Years."

- Experian (2020). "State of Credit 2020."

- Experian (2021). "Land of Credit 2021."

- Federal Reserve Bank of New York (2021). "Quarterly Report on Household Debt and Credit."

- Federal Reserve Survey of Consumer Finances (2021). "2019 Survey of Consumer Finances (SCF)."

- Sallie Mae (2019). "Majoring in Money 2019."

mcclainstroardlean.blogspot.com

Source: https://www.fool.com/the-ascent/research/credit-card-debt-statistics/

Posting Komentar untuk "What Is the Average Family Credit Card Debt in 2006"